Business License and Tax Certificate

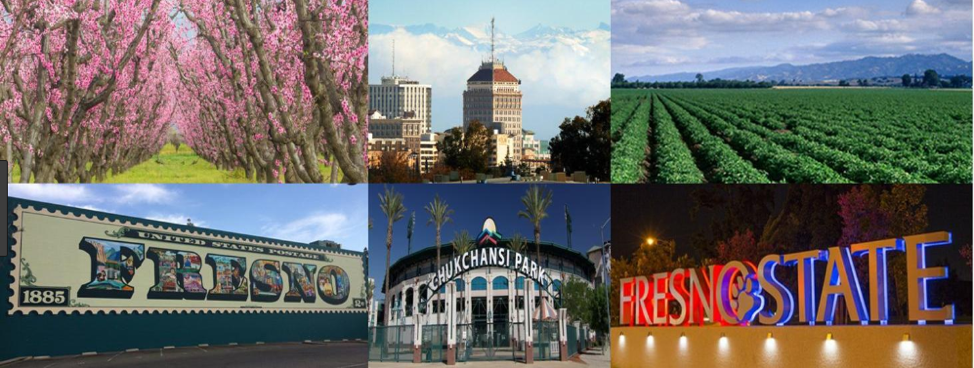

Welcome to the City of Fresno Business Tax Division!

We hope the information you find here will be helpful to you in your business operations. Access information about how to start your own business, apply for a business tax certificate, pay your tax payment online, start the approval process for business permits, download forms, look up information about existing businesses, view new business license recipients or use our Business Directory.

Our Frequently Asked Questions section has useful answers to many common questions. Or you may contact our Customer Service division at (559) 621-6880 or [email protected].

E-CHECK PAYMENTS To save business owners time and money, the City of Fresno now offers an E-check option for paying business tax renewals. Instead of paying a 2.3% convenience fee with a credit card, business owners can now choose to pay with E-check with a flat fee of $0.89 per transaction regardless of the amount owed. All E-Check payments made after 8:00 PM PST will be posted the next business day. You can expect to receive an email to print your certificate within 24 hours of your payment. The E-Check fee is not collected by the City of Fresno, but by the payment processor; and, therefore, will not be reflected on your business tax or dog license account. Customers may continue to pay with a check, by mail, or by check/cash in person without any additional charges.

The City of Fresno Finance Department works with over 25,000 businesses and events annually. The Business License sections of the Fresno Municipal Code state the requirements and regulations under which all businesses shall operate [FMC Sections 5-101 and 5-102]. There are usually questions by about the term “license” according to the Fresno Municipal Code. The term is not meant to construe a professional certification of an ability or accredited diploma by this municipality. Rather, it is a term referring to the ability of the City to gather revenue in the form of taxes where persons carry on any trade, calling, profession, or occupation in the City.

The term “permit” refers to the business activities engaged by persons or groups identified by the City Council as needing to be regulated or controlled for the good of the citizenry at large. See the Business License Checklist for further information on who needs to obtain a business license.

Therefore, as identified by the Fresno Municipal Code, particular businesses will be required to have both business license/tax certificate(s) and specific permit(s) for those activities stipulated by the code.

Please note there are other agencies and/or departments within the City system as well as county, state and federal governments, that may have requirements for permits [example, conditional use permits] that are in addition to and/or need prior approval.

In order that the city maintain service commitments, it is important that you provide accurate and complete information on the application[s] you submit. Modified, or incomplete information may cause delays and/or stop us from complying with your requests to legally conduct business within the City of Fresno.

Downloadable Resources

How do I update my tax records or get information?

Most transactions can be accomplished by phone (559) 621-6880. There may be certain aspects of a transaction on your tax account that may require your presence. Additional taxes and/or permit fees may be required if your business is located and/or covered within certain code jurisdictions such as hotels and motels, taxicabs, cardroom, dance halls, billiard rooms, mobile food vendors to name a few.

Additional Information

- City of Fresno Finance Department, 2600 Fresno Street, Room 2156, (559) 621-7001, FAX (559) 488-4636

- City of Fresno Department and Revitalization Resources Management (DARM) Zoning, 2600 Fresno Street, Room 3043, (559) 621-8003

- State of California Board of Equalization, 8050 N. Palm Avenue, Suite 205, Fresno, (559) 440-5330

- County Clerk Fictitious Names, 2221 Kern Street, Fresno, (559) 600-2575

Opening a New Business?

Please visit our Planning Division to obtain an approved Zone Clearance. This is required before you apply for a City of Fresno Tax Certificate. For more information about the Zone Clearance process, you may visit the Planning Division zone clearance page or you may visit the City Planning Division in Fresno City Hall at 2600 Fresno St, Room 3043. They are open Monday – Friday, 8:00 am – 5:00 pm.

When you apply for your business tax certificate, you are required to provide your approved Zone Clearance document. You may apply for your business tax certificate online or by mail with our printable Business License & Tax Certificate Application. You may also apply in person at the Business Tax Division public counter in Fresno City Hall. In all cases, please be prepared to provide your approved Zone Clearance document. Prevent an ADA lawsuit before it happens. Go to the Accessible Fresno Small Business Initiative for additional information.

City of Fresno Business Tax Division

2600 Fresno Street, First Floor, Room 1096

Monday-Friday 9:00 a.m. – 4:30 p.m.

Third Friday Office Closes at 3:00 p.m.

Customer Service (559) 621-6880

The Fresno Start-Up Guide

New Business Checklist

Owners and persons having ownership interest in businesses operating in the City of Fresno are required by the Fresno Municipal Code to obtain a Business Tax Certificate. The following questions are intended to help you assess your potential need to obtain a Tax Certificate.

- Am I involved in the retail or wholesale selling of merchandise, equipment or other material items?

- Am I leasing equipment or other items to others?

- Am I receiving revenue for providing personal, business or other services, including consulting and lobbying services?

- Am I receiving revenue from the rental of living accommodations, including rooming house lodgings, apartments, flats, courts or single family residences?

- Am I receiving rental revenue from commercial real property used by others to conduct business?

- Do I have a California State Contractor’s License?

- Am I an attorney, physician, Certified Public Accountant, insurance broker, dentist, architect, mortician, psychologist, psychiatrist, real estate agent or engaged in any other profession for which I have special certification or licensing issued by governmental or professional organizations?

- Am I a broker dealing in commodities, securities or services?

- Am I engaged in any activities not mentioned above which might be perceived by members of the community to be of a “business” nature?

If you answered “yes” to any of the above questions, and you do not already have a Business Tax Certificate for the activities mentioned above, you should contact the City of Fresno Finance Department’s Business Tax staff as soon as possible. Late compliance may result in penalty fees. The Business Tax Division is located on the ground floor of City Hall. Our Customer Service staff can be reached by telephone at (559) 621-6880.

Credit / Debit Card Fees

Customers who pay by credit card or debit card are now required to pay a 2.3% convenience fee in addition to the amount they choose to pay in business taxes, room tax or dog license fees. The convenience fee is not collected by the City of Fresno but by the card payment processor and therefore will not be reflected on your business tax or dog license account.

The fees will apply to credit card and debit card payments made at the public counter and on the online payment web site. VISA, MasterCard, Discover, and American Express credit cards are accepted. Only debit cards with a VISA or MasterCard logo will be accepted. Customers may continue to pay with check by mail and by check or cash in person without any additional charges.

Transient Occupancy Tax

New Hotel / Change of Ownership

Welcome lodging businesses! Thank you for choosing Fresno as your business location. We appreciate your business and hope to continue our long relationship.

For lodging businesses that have any person staying in their property for 30 consecutive days or less, the lodging property shall collect from the tenant the following and remit those amounts to the City:

- 12% Transient Occupancy Tax (TOT)

- 2% Tourism Business Improvement District Tax (TBID)

Apply for a Transient Occupancy Tax Certificate (English)

Apply for a Transient Occupancy Tax Certificate (Spanish)

Transient Occupancy Tax Renewal

Transient Occupancy Tax Renewal↗

EXEMPTIONS:

Tax-Exempt room receipts – 31 days & Permanent Residents

A permanent resident is an occupant who has the right to occupy a room for at least 30 consecutive days. Intent to occupy the premises in excess of 30 days must be presented to the hotel prior to or at check-in to qualify as permanent resident status. If documentation is not presented, the occupancy will be charged the TOT for the first 30 consecutive days. The 31st day and beyond is considered exempt from TOT.

30 Day Consecutive Days TOT Form

Tax-Exempt room receipts – Government Agency Occupants

Any government agency exemption that is claimed, are for any federal, California city, county, or state government officer or employee when on official business; not for personal use. The employee should provide the hotel documentation such as letterhead, e-mail, ID badge, or copy of itinerary on behalf of the federal state, or local government agency for validation.

Government Exemptions Form

City of Fresno

Finance Department

Business Tax Divisions

2600 Fresno Street, First Floor, Room 1096

Fresno Ca 93721

[email protected]

Short Term Rentals

If you rent your property, or a portion of your property, to a guest(s) on a short-term basis, you are subject to the City of Fresno requirements below and must obtain a Short Term Rental (STR) Permit.

- An STR Permit is required before the home or room(s) can be rented or advertised for rent.

- The STR permit holder must be the property owner.

- The STR permit expires annually on the anniversary of its issuance.

- The STR permit holder is responsible for preventing any nuisance activities, including noise, parties, etc.

- The STR permit holder is not required to pay business tax on the revenue earned.

- The STR permit holder is responsible for collecting and paying Transient Occupancy Tax (TOT) to the City of Fresno.

- If the STR property owner rents space for less than 31 days in a year, they are not liable to pay TOT.

You will first need to apply for a zone clearance:

- Make an appointment at: https://www.fresno.gov/planning/

- Apply Online: Click Here

- Step By Step Instructions: Click Here to Download

When you have an approved zone clearance, please complete the applications below and email the applications and the zone clearance to: [email protected]

Short Term Rental Permit Application

Short Term Rental Supplemental Application

FAQ

Frequently Asked Questions

Online Business Tax Payment

Offering E-Check option for business tax payments

Application for Business Tax Certificate

Please obtain a zone clearance first

Business Directory

Must have valid Business License with the City of Fresno

New Business License Report

Must have valid Business License with the City of Fresno

Municipal Code

City of Fresno Code of Ordinances and those not yet codified